Virgin media upgrades to ftth

https://www.analysysmason.com/research/content/articles/vmo2-fttp-upgrade-rdfi0

Virgin Media O2 is the largest cableco to announce a full FTTP upgrade

Virgin Media O2 (VMO2) announced, in July 2021, that it will upgrade all 14.3 million homes that are currently passed by HFC to FTTP by 2028, adding to the 1.2 million recently built homes passed. The technology used will be XGS-PON. This is the largest HFC-to-FTTP network migration to have been announced anywhere in the world. In this article, we discuss the rationale behind the migration, the implications for the market in the UK and the broader implications for cable operators worldwide.

The upgrade is surprisingly inexpensive

Virgin Media’s merger with O2 created an opportunity to increase the broadband service penetration of its current network, but the combined entity VMO2 now faces stiffer challenges from Openreach and altnets.

Total cost of ownership (TCO) is the main driver of the upgrade to FTTP. VMO2 indicated surprisingly low capex per premises passed (GBP100 (USD135)) for FTTP compared to that for DOCSIS4.0 (GBP60 (USD81)). This is the benefit of having access to ducts and a network that is already quite fibre-deep. Indeed, without ducts, capex per premises passed can be as much as five times higher. The low figure given by VMO2 could also indicate that more of the capex will fall to customer connections rather than passing the premises themselves. VMO2 gave few indications of how it would manage customer connections and technology migration.

VMO2 also claimed that the opex for FTTP would be lower than that for HFC. We estimate that cablecos could save around USD30 per year per home passed (so about USD75 per year per home connected if the network is 40% utilised), which would go some way to covering connection capex.

VMO2 indicated that the switch to FTTP would offer:

- increased relevance for the B2B market (though this necessitates some new build)

- a wholesale opportunity, though it provided little detail of when and how.

The upgrade will trigger some rationalisation of fibre infrastructure in the UK

Parent company Liberty Global had already signalled that this upgrade was possible in June 2021, so the announcement is not a huge surprise. The plan will have a different impact on each type of infrastructure player.

- The plan creates a major challenge for cable-footprint-focused altnets unless they can rapidly shift their attentions to other areas. New build capex is much greater than GBP100 (USD135), so the speed of their roll-out is critical. We assume that VMO2 will simply overbuild where CityFibre is now. If VMO2 provides wholesale access, there is a risk that Sky will take it.

- The implications for dense urban/MDU altnet specialists are harder to assess because there may be less overlap with the existing VMO2 footprint.

- There could potentially be an opportunity for non-cable-footprint altnets to partner commercially with VMO2 in some form (for example, via access swaps or as an input to an alternative national connectivity platform led by VMO2).

- The impact on Openreach will partly depend on the speed of roll-out. Openreach plans to pass 20 million–25 million premises by the end of 2026, so it is not hanging about. Pricing is also a factor. Openreach’s new ‘Equinox’ commitment-based pricing for FTTP is quite aggressive, but Openreach has less flexibility than VMO2 because there is a baseline-regulated 40/10 VULA charge and Openreach cannot do geographically deaveraged pricing. If VMO2 provides wholesale access, there is a risk that larger service providers will take it.

The broader outlook is that two main players are likely to take control of a large portion of the wholesale broadband market in the UK. Consolidation among altnets is likely. M&A may not be the most efficient means to achieve this; sharing a virtualised connectivity platform might be simpler.

VMO2’s decision bucks the trend for large cablecos to be proceed with caution

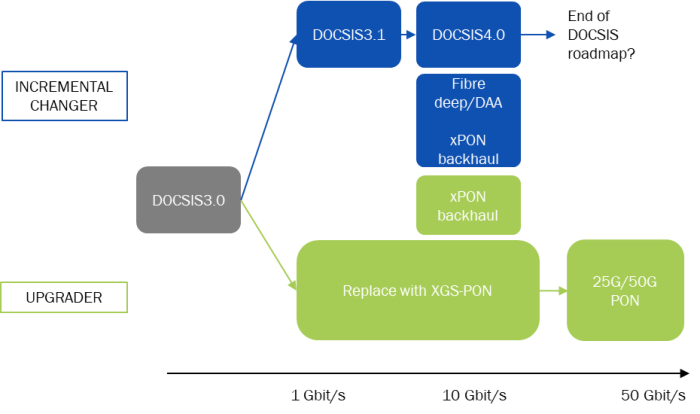

All cablecos know that a shift to FTTP is inevitable at some point; it is simple a matter of when and how. We can divide cablecos into the following two groups (see Figure 1).

- Incremental changers. These players are following the DOCSIS roadmap to DOCSIS4.0, but are pushing fibre deeper into the network. They are mostly larger players, many of whom have MNO arms for which 5G may be a capex distraction. US cablecos do not have a strong position in the mobile market, but their huge utilisation rates (50% and above) have encouraged a cautious approach.

- Upgraders. To date, these have mostly been smaller regional players with little/no mobile presence. They have been increasingly challenged by FTTP.

Figure 1: Overview of the two main options for cablecos

Source: Analysys Mason, 2021

Network opex will be lower for FTTP than for HFC because there are fewer active parts to maintain. The savings could be in the region of USD30 per year per home passed (so USD75 per home connected if the network is 40% utilised).1 This would go some way to covering connection costs, which would be intolerably high for end users if charged at cost. However, this saving can only be realised when operators remove the fixed costs associated with HFC.

The upgrade looks as if it will lead to a shift to wholesale access. Most other upgraders have indicated some sort of shift away from the standard cable vertically integrated model. Operators should see a better return on some sort of multiple-tenancy model, provided that they have other means (such as FMC bundling) to keep their retail churn low. DOCSIS can address most of the current needs of retail end users. However, wholesale DOCSIS has little chance of being selected ahead of operator FTTP (except, perhaps, as a short-term fix prior to an upgrade) among service providers looking for a long-term partner. In addition to broadband, access fibre can be used for small-cell x-haul and edge; DOCSIS is a non-starter as a competitor in this space.

Many operators now have ambitious FTTP plans. Cablecos cannot afford to hang around, especially if they have that critical asset: access to physical infrastructure.

- There is an opportunity for European cablecos to be as big as the wholesalers, and to extend their reach via virtualised wholesale connectivity platforms. Some operators look set to build wherever they can, but others, such as Deutsche Telekom, appear to be prepared to consolidate their position via a connectivity platform. There are good reasons for cablecos to do the same.

- US cablecos have long been dominant in the broadband market, but there is now significant renewed investment in FTTP by AT&T and others. FTTP will beat cable in the long term because it is better and cheaper to run. 5G FWA is a short-term distraction. Wholesale has not historically been a major component of the market in the USA except as simple resale, but it may be enough to encourage cablecos to rethink their old vertically integrated strategy.

1 Fiber Broadband Association (2020), Access Network OpEx Analysis White Paper. Available at: https://www.fiberbroadband.org/page/fiber-research.